Recently, I was in a discussion group with some very sophisticated investors of equities and real estate when I was asked if I was bullish about anything in the United States. I have been openly negative about our rising deficit and the lack of financial consequences for large banks and financial institutions that had been deemed “too big to fail” for quite some time.

I sat back and thought about the question and said that there are a number of things which give me a very positive outlook for the red, white and blue. Before this Apartment Reporter turns upbeat, I wanted to share a statistic to keep in mind when you see the oft reported unemployment figure that will be bandied about more and more as we head towards November.

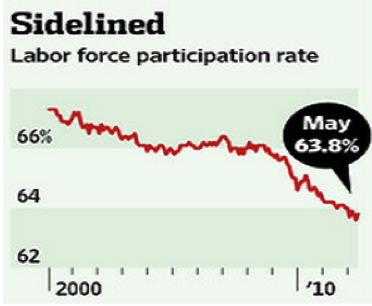

It is the participation rate of the working age population that are either working or looking for work. In Figure 1, we see the percentage today is 63.8% which is 2.3% lower than it was 4 years ago. This is a 30 year low.

Figure 1

Source: Bureau of Labor Statistics, The Wall Street Journal

Another measure is to divide civilian employed people by the total US population. It was 63% five years ago and today it is 58.6%. There is clearly too much slack in the American workforce which is a big drag on our economy and when you think about 4 out of 10 capable people not working, it makes the 8 or 9 percent unemployment rate look meaningless.

Now, please let me share some good news which will hopefully lead to higher employment and a better economy. Of course that will hopefully include full buildings for us all!

- Energy independence. While I have not enjoyed paying higher prices at the pump, this has lead to more Americans buying vehicles with better fuel efficiency and has increased our expansion of domestic fuel sources. Through breakthroughs in “fracking,” we are tapping into oil and natural gas reserves that are abundant domestically. Before I get letters, please let me say that I too want this done in a way that doesn’t harm the environment. As manufacturing often requires a lot of energy, if US costs are cheaper than most places around the world, I think that we will see more “on-shoring” of manufacturing jobs.

- Technology innovations. We are still the home of some of the best research and development in the world as evidenced by cutting edge companies continuing to form in the Silicon Valley. To be more specific, cloud computing, nanotechnology, battery innovations, green energy and yes, even social networking. While there are developments coming from around the world, the US is still the place to be if you are an engineer or an engineering student.

- Stability. I hear this more and more from foreign investors as there are serious concerns about the viability of the European Union (which I think will end up disbanding) along with the transparency of China. While I understand that we have our governmental issues, strong property rights and our legal system to work out disputes makes our country more attractive as a safe haven.

- Deleveraging. Since 2008, our real estate market has gotten kicked in the teeth. That said, we have seen a massive amount of debt get recast through foreclosure and also through refinancing we have seen debt payments plummet because of lowered interest rates. There was a finite amount of these toxic loans made during the real estate bubble and I would argue that we are more than half way through the cleansing process.

- Belief in the spirit of the USA. While I have had the luxury and pleasure of traveling around the world and respect the drive and focus that I’ve seen, there is nothing like the ingenuity and can-do spirit of Americans. Perhaps because our country is a melting pot who welcomes those with a desire for a better life or because I have witnessed American greatness during my lifetime, I feel strongly that the US will figure out its problems and continue to be a positive force in the future.

Some of you may be thinking that I am an overly patriotic homer who has lost objectivity and to some extent you are right in that I am thankful for a country which has provided so many opportunities for me. That said, the reasons for optimism that I listed are real and while I’ve invested in Asia and Europe, my money is currently purchasing real estate right here in the US so as usual, I eat my own cooking. Today, I wired money for an investment cooked up in Atlanta and it tastes good!

Kyle Kazan

Chief Economist

Contrarianomics