Three weeks ago I was in the best and final stage of negotiations for purchase of a large apartment complex in Atlanta. The seller had selected three potential buyers (from a pool of over 15) and asked them to sharpen their pencils to make the best offer possible. This was followed by an interview by the sellers and their brokers so they could ask direct questions regarding potential for re-trading (asking for a price reduction / credit during escrow, presumably for capital improvement items found during the inspection).

After a few days, we received the news that the seller had selected one of the other 2 groups because they were in a 1031 exchange and presumably had more motivation than I did since I was bringing new money into the deal. My team had worked really hard in evaluating the opportunity as was understandably disappointed as was I.

One of my frustrations over the last couple of months has been Capitalization Rates (Return on investment when an investment is purchased without debt) continue going lower yet interest rates have been moving up. At the peak of the market in 2007, Cap Rates were lower than the borrowing costs which meant a negative equity scenario and in my book that means were are in seriously bubblicious territory. We are not there as of yet but that is the trend unless interest rates go down, prices of properties are lowered and/or rents rise significantly.

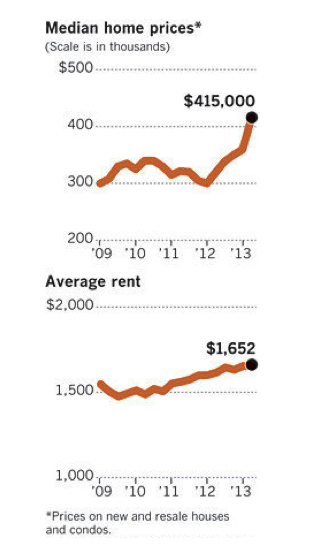

At the same time, while the recovery in housing prices across the United States has roared back causing values to move up significantly, rents haven not come close to keeping pace. Since I essentially valuing real estate as a percentage of the rent it can collect, anytime I see a large difference between the two trends, it catches my attention. Over the last 100 years, rents and values in the US have moved up and down in lockstep so when they separate, it has only been temporarily.

In Figure 1, we see pricing of median single family home prices and average rents in Los Angeles. Las Vegas, Atlanta, Miami, Austin along with most markets around the US show a similar disparity.

Source: Marcus & Millichap Research Services, MPF Research, DataQuick, Los Angeles Times

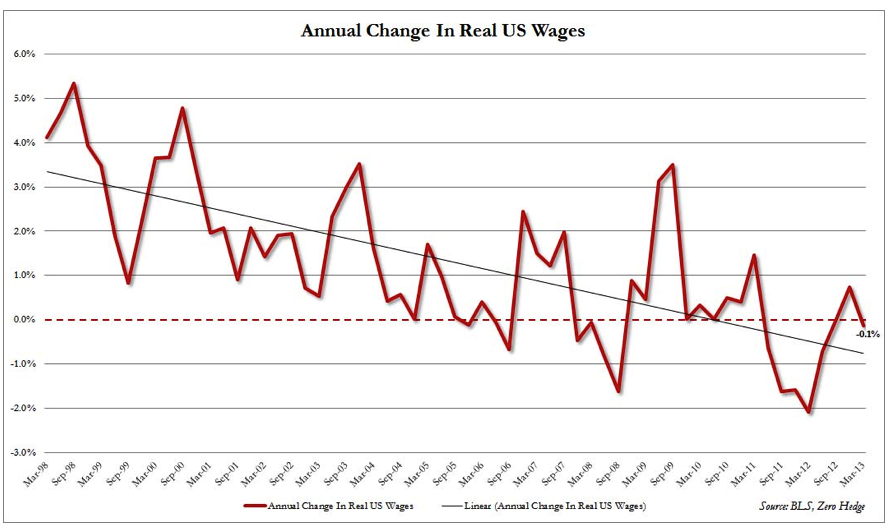

Nationally, we are not seeing wage growth even though the unemployment rate is dropping. In Figure 2, we see the trend from 1998 in US wages. Many higher paying manufacturing jobs have been taken overseas and have been replaced by lower paying service jobs which likely accounts for the slide. I’m hopeful that we will see that graph move the other way.

I received a call on Friday from the brokers in Atlanta to find out if I would be interested in the large property for which I wasn’t previously selected to purchase. Because of the quick jump in interest rates along with a widening spread from Fannie Mae and Freddie Mac (their mandate has been to do 10% fewer loans this year than in 2012 so their pricing is moving up), the pricing for the winning bidder no longer made sense. The game in this deal now is to find out who will factor in higher interest rates the least. I am crunching numbers…

As QE 3 ends, I see this as the new paradigm throughout our industry. One more thing to be considered is that as interests rate rise, banks will pay more for deposits so return on real estate investments will need to go up too.

The pressure cooker on pricing is heating up and something has to give.